“Our approach is to manage risk intelligently, enabling us to pursue numerous opportunities with minimal dilution. Ultimately, our aim is to lead the pack in greenfields exploration globally, creating substantial value through diverse means, from royalties to full ownership, ultimately ensuring value creation.”

Christopher Drysdale, CEO

Project Generator vs Traditional Junior

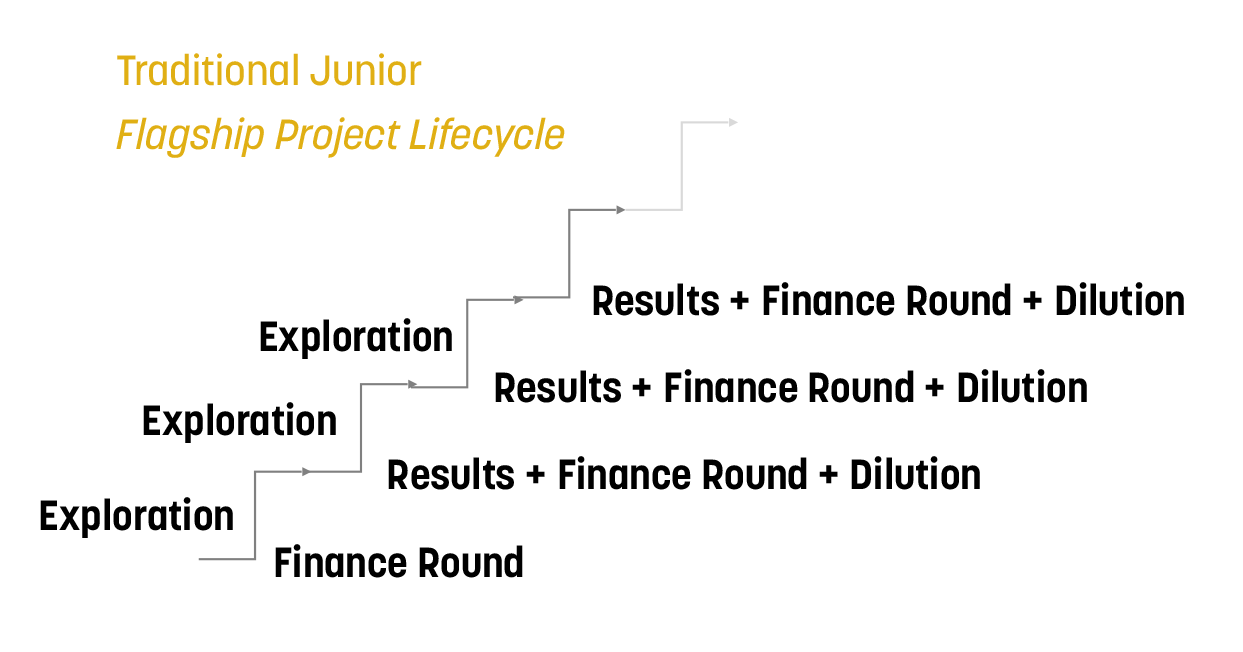

The Dilution Risk

Traditional junior resource companies often resort to raising capital through equity offerings to fund costly drill programs in their pursuit of making a discovery. However, this leads to dilution of investors' stakes.

Project generators opt to bring in partners to fund advanced exploration and drilling in exchange for an interest in the property. This model mitigates the dilution risk and allows for the advancement of exploration without the need for repeated share offerings. The partner's funding commitment over a period of years, joint venture agreements, and potential benefits for the original shareholders from the success of the partner

Antler Gold’s Unique Business Model

Experts In Project Generation

Maintain a diverse project portfolio and financing exploration through joint-venture partnerships with mid-tier or major mining companies. By acquiring mineral-rich prospects and optioning them to partners, Antler aims to generate short-term revenue, mitigates risk and leverages external capital to fund high-risk drilling phases, contributing to an effective de-risking strategy in mineral exploration and preserving its shareholder’s capital for investing in the next discovery opportunity.

Investors benefits

- Efficient project advancement

- Diversified exposure to the commodities cycle

- Potential upside through proven operators and assets.

- Offers a balanced perspective on risks and rewards.

Key Accomplishment Summary

Namibia

![]()

Onkoshi

New license issued on the Onkoshi Gold Project in central Namibia bordering to the south-east of the known Erindi and Vredelus gold prospects

![]()

Paresis

New license for the prospective Paresis Gold Project issued, located in northern Namibia within the 'gold corridor' that hosts the Otjikoto (B2Gold), Ondundu and recently discovered Eureka gold deposits (Osino Resources)

![]()

Erongo - Optional

During the year ended December 31, 2024, the Company signed an agreement and later an Amended Definitive Agreement (the “Agreement”) with Fortress Asset Management LLC (“Fortress”), an arm’s-length private company. Pursuant to the Agreement, Fortress will acquire an 80% interest in the Company’s Erongo Gold Project (the “Project”) in exchange for Cdn$4.11 million in shares of an entity controlled by Fortress (“FortressCo”) prior to it becoming publicly listed and a payment of US$800,000 within ten business days of it becoming publicly listed. FortressCo will also issue Antler a 2% net smelter return (“NSR”) across the entire Project. Fortress has paid US$50,000 under the terms of the initial agreement. Fortress also has the right to acquire the remaining 20% interest, on or before the third anniversary of FortressCo becoming publicly listed, for US$1.7 million, of which at least 50% is payable in cash and the remainder in shares of FortressCo. Should FortressCo fail to become publicly listed by the timeline indicated in the Agreement, Fortress will have the option to make all payments to Antler in cash.

Antler will act as the operator for the Project for an initial 24-month period following the completion of the Agreement. The Agreement was subject to the shareholder approval, as well as the approval of the TSX Venture Exchange. The Company received shareholder approval and regulatory approval from the TSX Venture Exchange during the period ended March 31, 2025.

![]()

Ziggy

New license issued for the Ziggy Cu Project in southern Namibia with historical grab sample grading 13% Cu.

Zambia

![]()

Kesya

Further exploration worked planned to follow up on previous sample results on license issuance.

Where we are going

Antler has developed a unique and risk-diversified business model that is focused on project generation and organic royalty creation in Africa’s Top-Ranked Jurisdictions. The objective of this strategy is to generate short and long-term revenue opportunities whilst providing the Companies shareholders with the potential multiple returns that are generated from the discovery process. Antler continues to assess new regional opportunities with the aim of building a diversified project portfolio.

The Model in Action